jersey city property tax delay

General Property Tax Information. City of Jersey City.

14 Self Storage Marketing Ideas Marketing Ideas Storage And Cube Storage

In Jersey City the average residential school tax in 2021 was.

. HOW TO PAY PROPERTY TAXES. 2 tax on medical cannabis sales made between July 1. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

I did get an email from Jersey City OEM about it. Guidance on the phase-out is as follows. Jerseycity 13 Posted by ud1nny 4 years ago FYI.

Property Taxes are delayed. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. By Mail - Check or money order payable to.

Jersey City property taxes are due quarterly on February 1 May 1 August 1 and November 1. 280 Grove St Rm 101. Grace periods extend to the 10th of these months and an interest charge will be added to payments made after these dates.

City of Jersey City - Delayed Tax Bills The 2017 final tax bill has not yet been mailed. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Online Inquiry Payment. New Jerseys real property tax is an ad valorem tax or a tax according to value. The standard measure of property value is true value or market value that is what a willing.

Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. The taxability of medical cannabis began phasing out on July 1 2020. Property Taxes are delayed.

Jersey City establishes tax levies all within the states statutory rules. The order followed an investigation from the state a series of escalating statements from the treasury and accusations of personal and political agendas in the mix. Samantha MercadoPatch JERSEY CITY NJ Jersey City property owners will get a refund in their next tax bill following an overcharge on the last bill.

6 comments 100 Upvoted This thread is archived. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without being hit with interest charges for the late payment.

Rather the issuance of bills was delayed pending. Due to changes made by the State of New Jersey to the awarding of State Aid to the school districts. City of Jersey City Tax Collector.

In Person - The Tax Collectors office is open 830 am. Monday August 7 2017 103802 AM EDT Subject. Real estate evaluations are undertaken by the county.

Effective July 1 2022 retail sales of medical cannabis will be exempt of Sales and Use Tax. The overcharge was flagged by residents in. 4 Sales Tax on medical cannabis sales made between July 1 2020 and June 30 2021.

On April 4 2016 the New Jersey Treasury ordered Jersey City to complete a tax revaluation by November 1 2017 with new values to take effect for the 2018 tax year. Nothing is due today. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

The administration did not issue estimated tax bills in 2021 as what has been done in the past. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Sensationalism Drowning Out Questions From Local Taxpayers Drowning City Manager Locals

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

Instagram Bot Takipci Satin Al V 2021 G

City Of Jersey City Online Payment System

Explore Our Free Eviction Notice Template Nj Eviction Notice Being A Landlord Templates

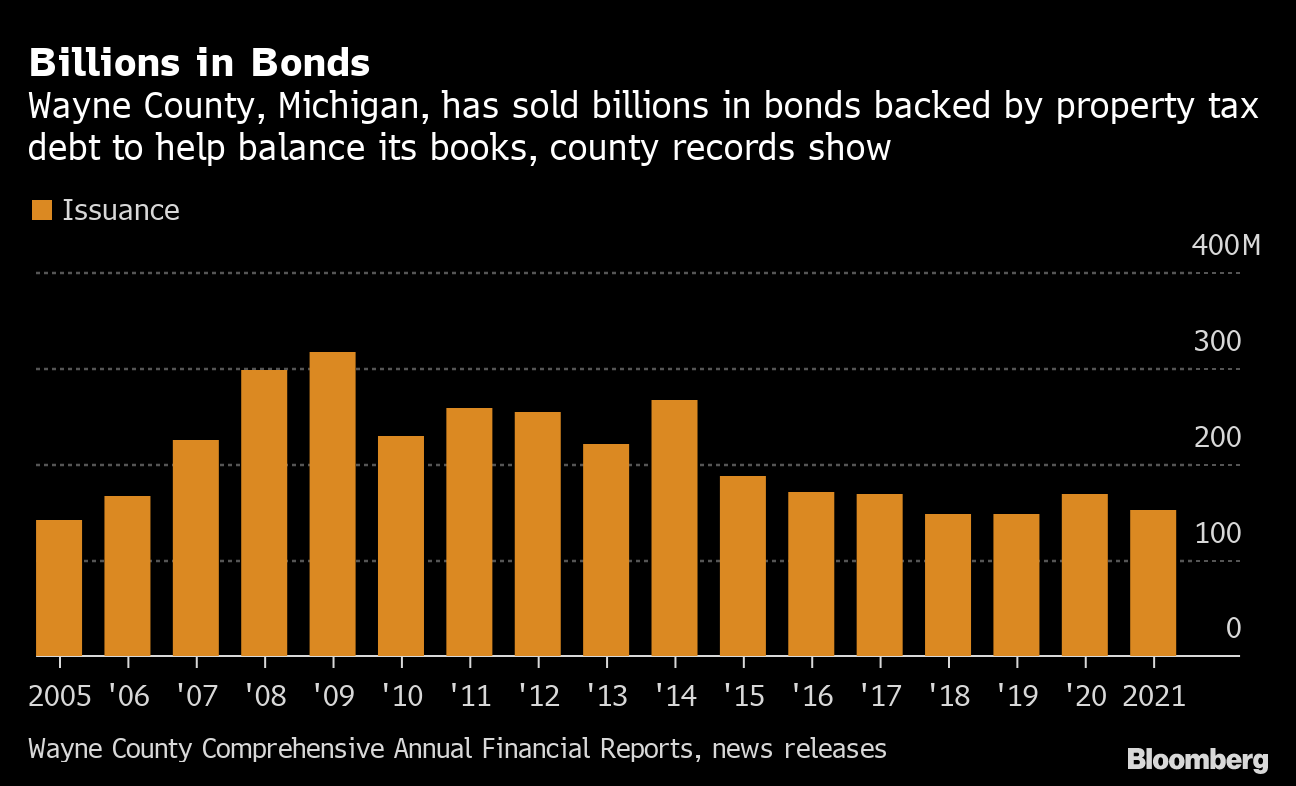

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

New York Property Tax Calculator 2020 Empire Center For Public Policy

Property Tax Revenue Up 89 On Price Trend

Property Taxes Haldimand County

The Official Website Of City Of Union City Nj Tax Department

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

Property Tax Debt Scheme Minority Families Lose Homes To Money Machine Bloomberg

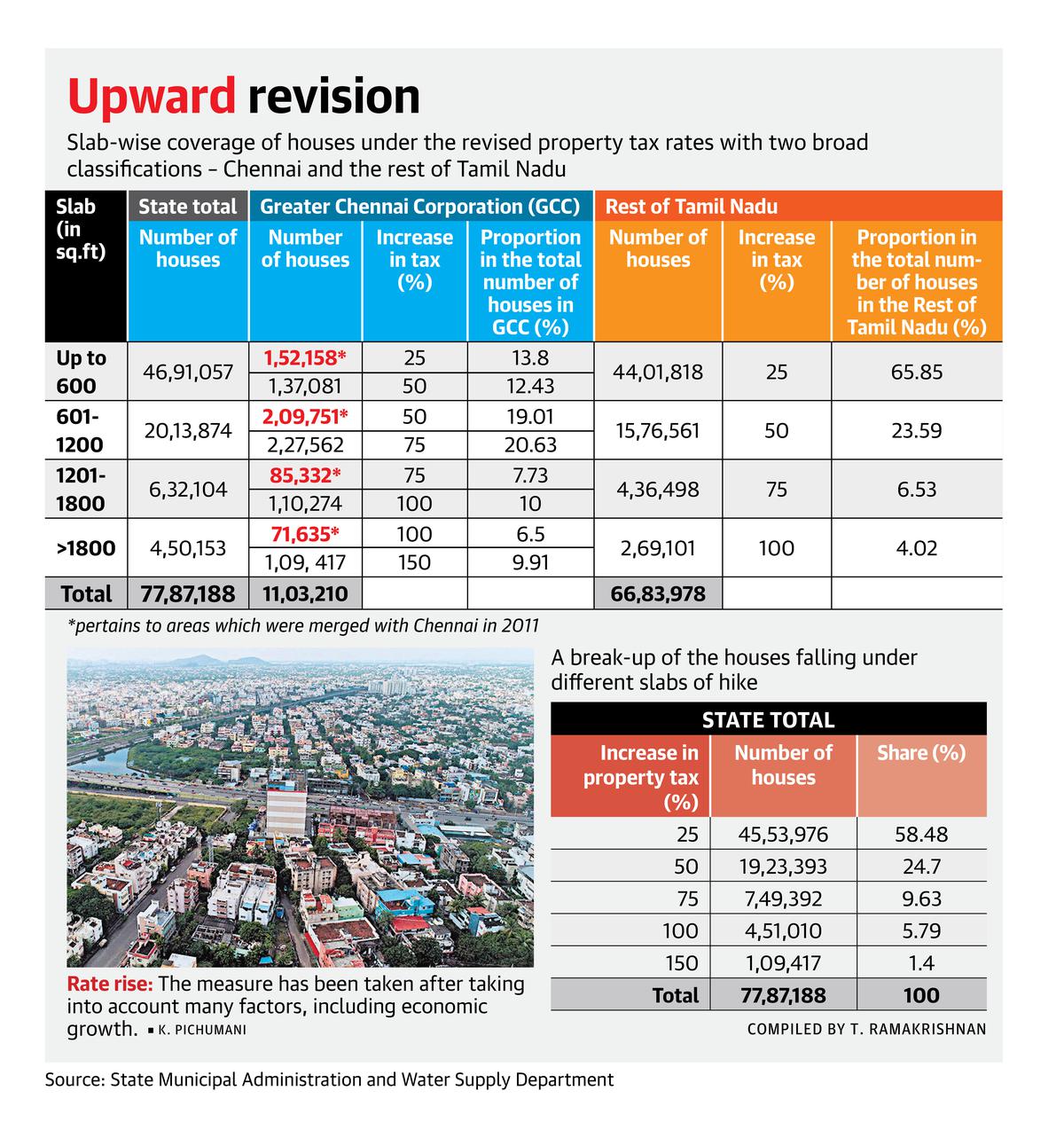

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

If We Have Commercial Property Then We Have To Pay The Lot Of Taxes And There Four Ways To Value Commercial Property Like Building Property Valuation Property

Free Eviction Notice Texas Template Pdf Sample Eviction Notice Letter Templates 30 Day Eviction Notice